Limited recourse borrowing arrangements (LRBA)

Self Managed Superannuation Funds (SMSF) are not prohibited from borrowing money providing the arrangement entered into satisfies the conditions specified under the Superannuation (Industry) Supervision Act (SISA) 1993. Section 67A(1) of SISA provides an exemption from the basic prohibition on SMSF borrowings where:

- The borrowing is applied for the acquisition of a single acquirable asset;

- The borrowing is to be used to purchase an asset that is held on trust for the SMSF;

- The SMSF must receive a beneficial interest and a right to acquire the legal ownership of the asset through the payment of instalments;

- The loan must be applied to an asset that the fund is permitted to acquire under the superannuation law; and

- The lender's right to recoup against the loan must be limited to the asset purchased.

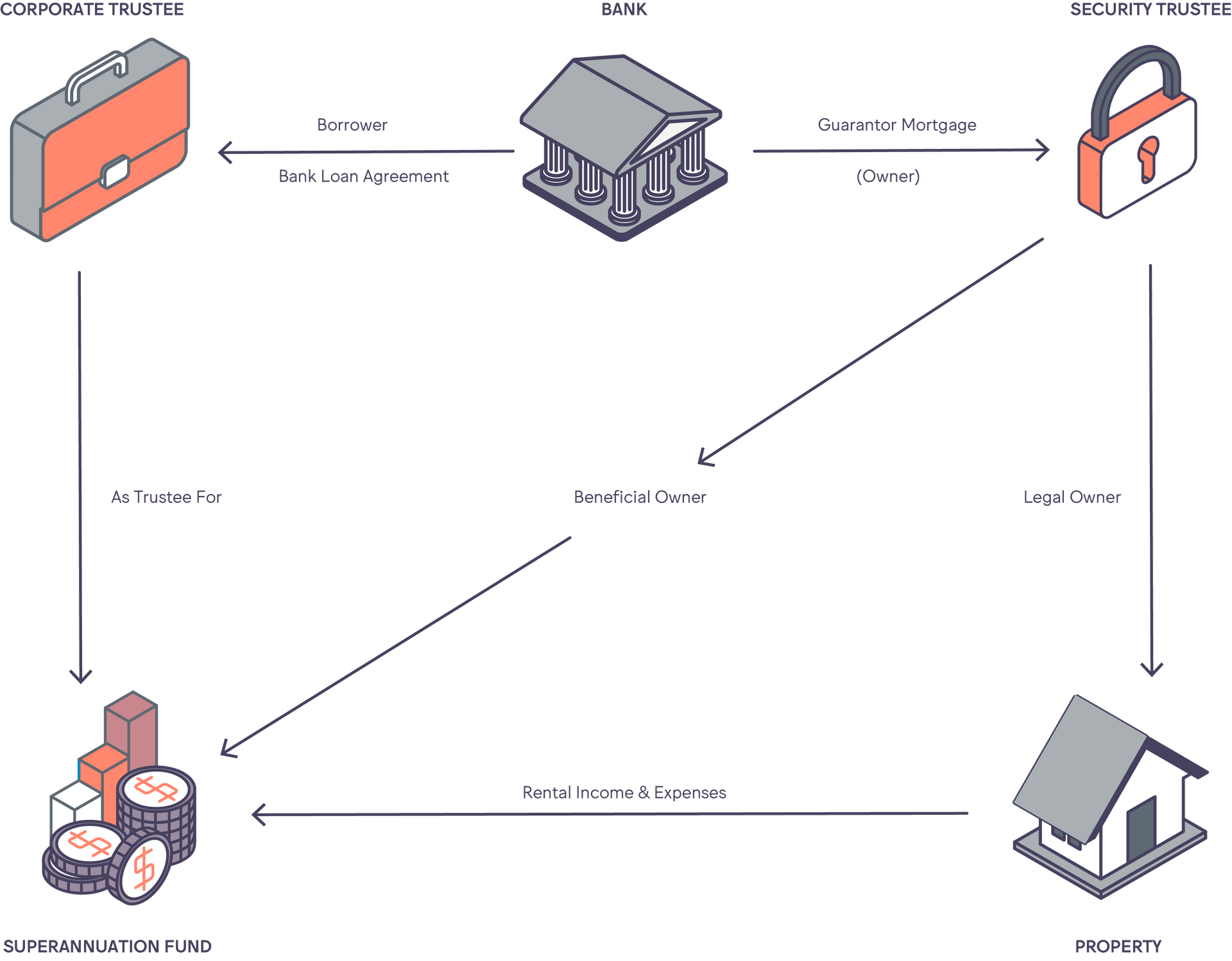

Limited recourse borrowing arrangements (LRBA) Diagram

Borrowed monies cannot be used to improve an asset, therefore, you cannot borrow money to renovate an existing property or to develop land owned by the SMSF. However, trustees may make subsequent draw downs under an LRBA for the purposes of maintaining or repairing the asset subject to the LRBA. The asset can be replaced by another asset that the SMSF is allowed to acquire but only in very limited circumstances.

Determining an 'Acquirable asset' and 'single acquirable asset':

Both proprietary rights (legal form) and the physical object of the proprietary rights need to be taken into account when considering whether a single acquirable asset has been acquired. Often, it is obvious but may not be in cases such as land over multiple titles.

Factors that support the conclusion that a single object of property is being acquired include:

- The existence of a unifying physical object, such as a fixture attached to land which is permanent in nature and not easily removed and that is significant in value; and

- Whether under State or Territory law, the two assets must be dealt with together.

The following circumstances would not be sufficient to support the conclusion that a single object of property is being acquired:

- There is a physical object situated across two or more titles, and that physical object:

- Is not significant in value; or

- Is temporary in nature and otherwise able to be relocated.

- a business is being conducted on two or more titles; or

- the vendor wants to deal with the assets as a package.

Distinguishing between 'maintaining', 'repairing' and 'improving' a single acquirable asset:

There is no need to distinguish between 'maintaining' and 'repairing', as both are allowed to be funded from borrowed monies under section 67(A) of SISA.

- Maintaining means work done to prevent or in anticipation of future defects, damage or deterioration of an asset to ensure the continued functioning of the asset in its present state.

- Repairs refer to restoring the function of the asset without changing its character and may include restoration to its former appearance, form, state or condition. If work on the asset restores the function of the asset to what it was at the time it was acquired, and uses similar or modern equivalent materials, it is a repair.

- An improvement refers to when the state or function of the asset is significantly altered for the better through substantial alterations, additional features or rights to the asset. Alterations will not amount to an improvement if the state or function of the asset is only bettered to a minor or trifling extent.

Whether an asset is the same asset or a different asset:

Consideration of both the proprietary rights and the physical object is required to determine if those alterations or additions made to the asset fundamentally change the character of that asset.

Borrowings under an LRBA cannot be used to improve an acquirable asset, but money from other sources could be used to improve (or repair or maintain) that asset. For example, accumulated funds held by the SMSF may be used to fund the improvements. However, any improvements must not result in the acquirable asset becoming a different asset.

Risks

With investing comes risk. When you add gearing to an investment strategy it magnifies the risk. Where the property is negatively geared the fund will be making a short-term loss on the basis that property prices will continue to rise and therefore make a capital gain when it is sold. If the debt within the SMSF is high, there is an increase in the inherent risk of the fund where a fall in the value of the property may cause the lender to call upon the loan sooner.

There is also risk in liquidity where the debt or geared assets is greater than a member's balance. In the event of that member's death, a lump sum death benefit may be called to be paid from the fund. If the fund has no liquid assets to pay this, the geared asset will need to be sold and the loan relinquished. Despite the risks with a gearing strategy, there are a number of ways to help reduce the risks. One solution is through the use of appropriate insurance products.

SMSF Trustee Requirements

A SMSF Trustee borrowing funds on behalf of the SMSF must ensure that:

- The loan complies with the SIS Act, including the lenders rights against the SMSF trustee for a default on the borrowing being limited to the underlying asset only;

- The fund has sufficient cash flow to repay the principal and interest (without relying on member contributions);

- The SMSF deed allows the SMSF trustee to borrow and acquire the relevant asset (you may need a legal review of the trust deed);

- The transaction is consistent with the SMSF investment and risk management strategy (the investment must be in the best interest of members and the risks and benefits have been considered)

- A declaration of trust is executed between the security trustee and fund trustee; and

- The structure of the transaction and the investment is signed off by the fund auditor as compliant with the Superannuation Industry Supervision Act (SIS).

Documents Required

- SMSF Deed Establishment/Amendment

- Security Trust

- Loan Documentation

- Mortgage Documentation

- Lease Documents (where required)

This list is not exhaustive and may vary dependent on your lender and lawyer.

The lender can be a bank, non-bank financial institutions, specialist financiers, margin lenders or a related party.

Establishment Costs

- Stamp Duty (property) and conveyancing

- Lender's fees

- Legal advice, preparation of documentations and lending documents

- Insurance – personal (life and salary continuance) and general (building, contents) accounting and taxation advice

- Financial advice

The cost of the above services will vary, but approximate costs can be provided on request.

SMSF Trustee Considerations

Issues for SMSF trustees to consider when borrowing are:

- The sole purpose test – assess the situation to ensure the investment is for the sole purpose of providing member benefits

- The investment strategy – are the fund's investment strategy and risk management procedures in line with their investments?

- In-house asset rules – do they apply?

- Related party acquisitions – a super fund is prohibited from acquiring assets from members and related parties except for business real property and listed securities

- Arm's length – the terms and conditions of the borrowing arrangement must be as if the transaction was done at arm's length

- Cash flow – the fund must have sufficient cash flow to pay interest

- Commercial matters – assess the investments from a commercial viewpoint for acceptable returns and expenses such as tax (including CGT, GST and land tax) and stamp duty, and

- Regulation – There is the potential for the rules to change in the future: a limited window of opportunity may apply.

Discuss Further?

If you would like to discuss this, please get in touch.

Disclaimer

The information provided in this information sheet does not constitute advice. The information is of a general nature only and does not take into account your individual situation. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you contact Brentnalls SA before making any decision to discuss your particular requirements or circumstances.